- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

Section 5.3

Financial Planning

A TAM financial plan describes the sources of an organization’s funds and how funds will be used over time on TAM activities. Resource allocation and TAM financial planning are closely linked activities. TAM financial planning both contributes to the resource allocation process and uses its results.

Financial Planning

A TAM financial plan describes the sources of an organization’s funds and how funds will be used over time on TAM activities. Resource allocation and TAM financial planning are closely linked activities. TAM financial planning both contributes to the resource allocation process and uses its results.

- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.3.1

TAM Financial Plan

A financial plan describes the sources of an organization’s funds and how funds will be used over time. Fundamentally, an organization prepares financial plans because it is good business practice and because doing so is required to comply with various state and federal requirements and accounting standards.

TAM Guide Book Club #4: Improving TAM Financial Planning

MPOs are required to prepare financial plans as part of LRTP and TIP development. DOTs also have to prepare financial plans for their NHS TAMPs. The federal requirements help guide practice in many agencies. However, there are often additional state-level requirements for financial planning and reporting that may impact the preparation of financial plans.

The financial plan prepared for an MPO LRTP requires system-level estimation of costs and revenue sources with reasonably expected availability to adequately operate and maintain the federal-aid highways included in the plan. LRTPs have a planning horizon of 20 years or more, but beyond the first 10 years of the plan the costs may be specified using aggregate cost ranges. MPOs, transit operators and states are required to work together to develop the financial plan. Requirements for LRTP financial plans are listed in 23 CFR 450.324 (f)(11).

The financial plan for a MPO TIP serves a similar purpose as for an LRTP: to show that funding is reasonably expected to be available for projects within the plan. Funds must be estimated by year for over a period of at least four years. A TIP financial plan does not need to include funding for other activities outside of the projects included, but should include some form of system-level estimation of costs of operating and maintaining federal-aid highways, as well as confirmation that sufficient funds are available for implementing, operating and maintaining the system. As in the case of LRTP financial plans, MPOs, transit operators and states are required to work together to develop the plan. Requirements for TIP financial plans are listed in 23 CFR 450.326 (j).

For SLRTP and STIPs, the elements of a financial plan are similar to those for LRTPs and TIPs, respectively. However, the financial plan for these documents is an optional element. SLRTP requirements are described in 23 CFR 450.216 and STIP requirements are described in 23 CFR 450.218.

Separate requirements specify the contents of a financial plan prepared for a State’s NHS TAMP. 23 CFR 515 specifies that a TAMP financial plan is a “long-term plan spanning 10 years or longer, presenting a State DOT’s estimates of projected available financial resources and predicted expenditures in major asset categories...”

TAM Webinar #28 - Financial Plans and Investment Strategies

Regulations further stipulate that the process for preparing a financial plan must include:

- Estimating the cost of expected future work to implement the investment strategies in the TAMP by fiscal year and work type

- Estimating funding levels that are expected to be reasonably available by fiscal year

- Identifying anticipated funding sources

- Estimating the value of the agency’s NHS pavement and bridge assets

- Estimating the needed investment on an annual basis to maintain asset value

TIP

Risk can be incorporated into resource allocation informally (as general considerations) or more formally (e.g. through the life cycle management process or as a criteria in a multi-objective decision making process).

TAM Webinar #48 - Improving Your Next TAMP Miniseries: Improving Your Financial Plan

In addition to preparing financial plans in the documents described above, state DOTs and other organizations typically prepare annual financial statements. The U.S. Governmental Accounting Standards Board (GASB) establishes standards for state and local governments to use in following Generally Accepted Accounting Principles (GAAP). These standards describe how governments should perform their accounting and prepare financial statements. A financial statement prepared based on GAAP describes an organization’s financial position for a given reporting period, such as a fiscal year, and typically does not include detailed projections of future funding and work. A financial statement prepared to comply with GASB standards and a financial plan prepared to support an LRTP, TIP or TAMP are meant to serve different purposes, but the same underlying concepts inform the development of all these products.

Financial statements and Federally-compliant NHS TAMPs both include calculations of asset value. Reporting asset value in a TAM financial plan helps communicate what assets an organization manages in a common unit applicable to all assets: dollars. Estimates of asset value in a TAM financial plan are typically based on asset replacement cost. The value of an asset may be depreciated on remaining asset life or current asset condition. Where a depreciated asset value is calculated the cost to maintain asset value is equal to annual depreciation. This can provide a useful benchmark for the minimum spending required to maintain an inventory of assets.

The asset value reported in a financial statement is prepared in compliance with GASB requirements, and is often prepared differently than that in a TAMP. For financial statements agencies typically apply straight-line deprecation to historic capital costs to estimate the current book value of their assets. The historic cost of constructing an asset is different from the cost to replace an asset in today’s dollars, and the annual depreciation calculated using this approach is different from the cost of actually maintaining asset condition. GASB requirements allow for addressing this issue using a “modified approach” for calculating asset value. This alternative approach involves calculating a cost to maintain assets using an organization’s management systems in lieu of calculating straight-line depreciation. Where this approach is used it provides a calculation of asset value that can be used in both a TAM financial plan and an organization’s GASB-compliant financial statement.

- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.3.2

Implications for Resource Allocation

In determining how to allocate financial resources, a decision-maker needs information on available funds. The output of the resource allocation process is an allocation of funds or other resources needed for the financial plan. Thus, financial planning both informs the resource allocation process and uses its results.

Development of a financial plan is separate from, but closely related to, the resource allocation process. Thus, there must be a high level of coordination between financial planning and resource allocation, particularly with respect to TIP and TAMP financial plans.

Although different financial plans are required for different applications, for practical purposes an organization should use consistent assumptions in developing its financial and strategic plans to the fullest extent possible, including the plans described above and other related documents.

Areas where integrated approaches and assumptions between different planning documents are most beneficial are:

- Revenue projections. Ideally, a single office or group should take responsibility for projecting future revenues incorporating the organizations best estimates of revenue sources, demographic trends and other factors.

- Inflation assumptions. To predict how much it will cost to perform work in current dollars it is necessary to apply an appropriate inflation assumption. Predicting future inflation is challenging and results of the resource allocation process may be highly sensitive to the assumed inflation rate. Thus, it is important for an organization to make a consistent set of assumptions concerning inflation in its different financial plans. Often, the same unit responsible for revenue projections also predicts future inflation.

- Operating and maintenance costs (O&M). Costs of operating and maintaining existing assets may be components of the different federally-required plans, but they typically are not a focal point of the planned use of capital funds. From an asset management perspective, it is important to accurately predict these costs and include them as part of any financial plan.

While integrating approaches is highly desirable, the varying scopes and requirements for different financial plans and statements may lead to different results even when approaches are integrated. Financial planners should still carefully document and communicate any areas where different financial plans and statements appear to diverge.

Such instances can result from:

- Timing of plan preparation. A transportation agency’s financial situation may change from year-to-year or even day-to-day. A financial plan captures an agency’s best estimates at a given point in time, and it is not uncommon that the financial assumptions made for a given plan will be different when revisited for another plan at a later time.

- Different planning horizons. Long-range plans, TIPS and TAMPs all have different planning horizons. The length of the planning horizon can impact how numbers are presented in a plan and how they are communicated. For instance, the aver- age annual O&M cost for the Federal-aid system, stated in current dollars, will be different over a 20-year period than over a 10- or 4- year period due to the effects of inflation and changing system conditions.

- Different contexts. Although using consistent assumptions and approaches between different financial plans and statements is desirable, in some cases the varying contexts and requirements demand the use of different approaches. An example of this issue is in asset valuation described in the previous section.

TIP

Although closely linked, financial planning should not be confused with resource allocation.

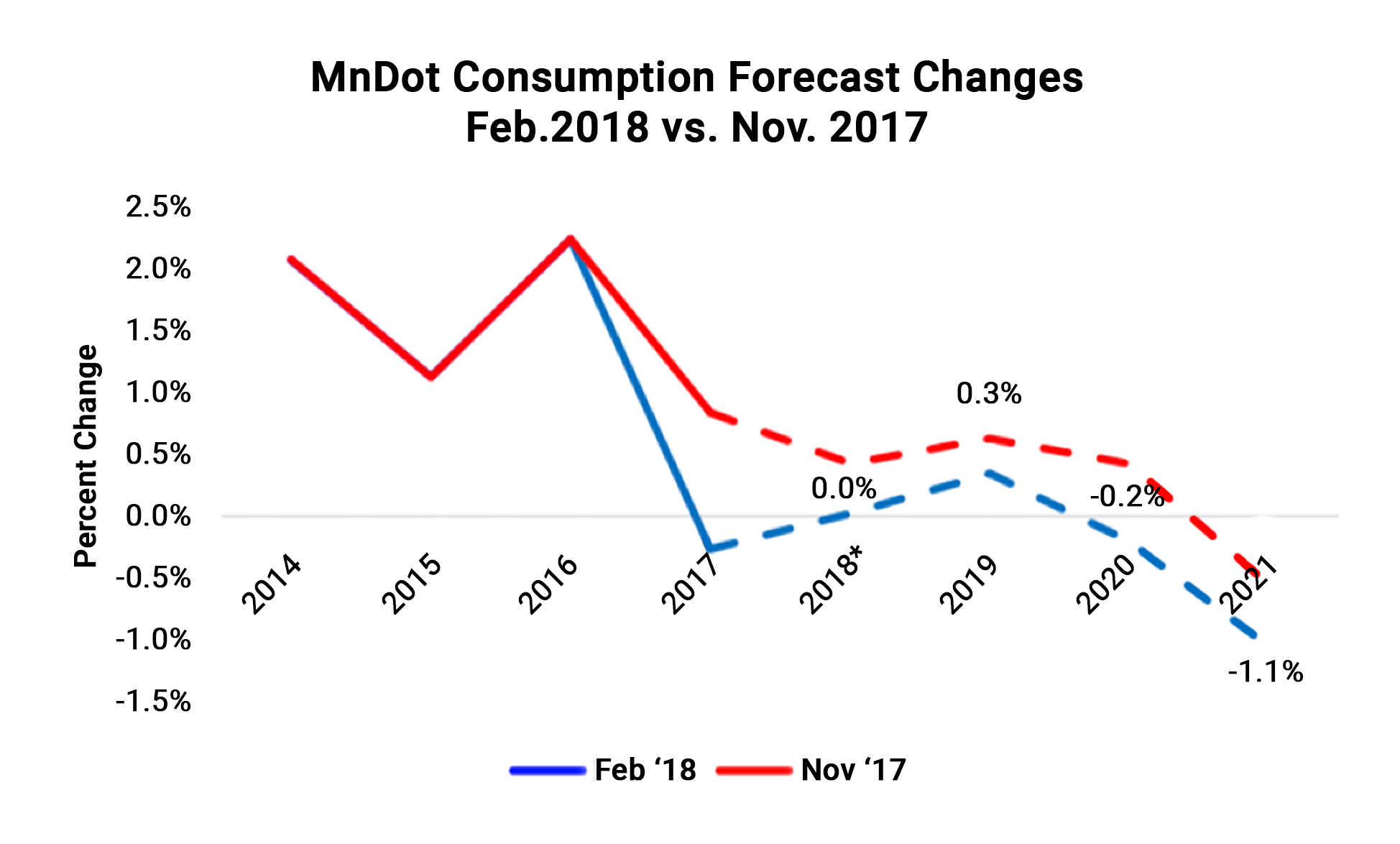

Minnesota DOT

MnDOT forecasts future funding in its annual Transportation Funds Forecast. This document projects funding by source for a four-year period. The report includes the funding projection, as well as additional details supporting the projections. For instance, it details trends in key parameters that impact funding, such as fuel consumption and vehicle sales. For these and other parameters the report shows historic trends, prior projections, and revised projection. The graph below, reproduced from the 2018 report, shows data for historic and predicted fuel consumption. The report also documents reasons for any changes in the projections, and risks that may impact future revenue. MnDOT uses its revenue projections to support development of the STIP, as well as to inform the funding projections in other reports, such as the TAMP and LRTP.

Source: MnDOT Transportation Fund Forecast. 2018. https://www.dot.state.mn.us/funding/documents/Transportation%20Forecast%20Feb%202018.pdf

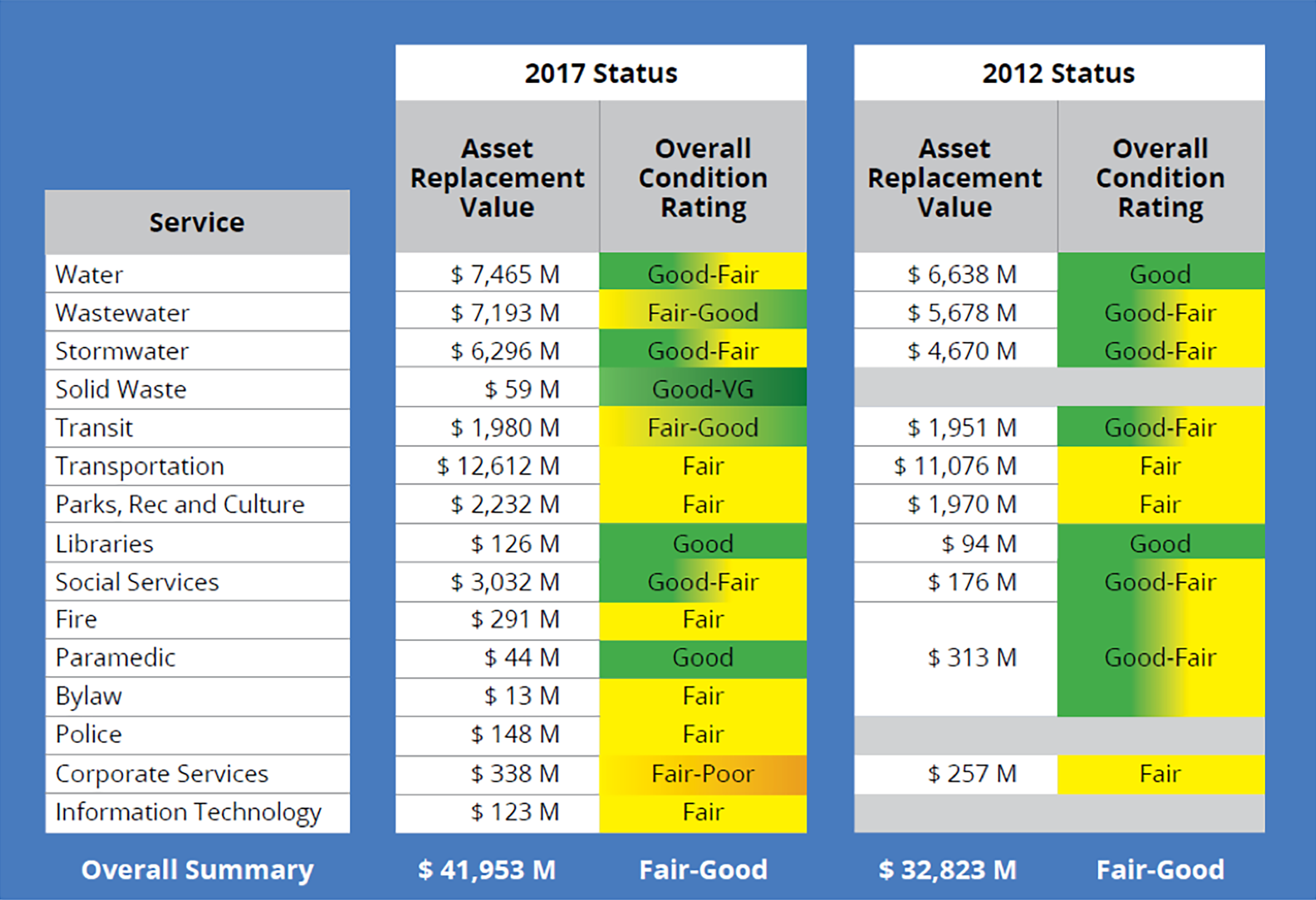

City of Ottawa

The Province of Ontario was one of the first jurisdictions in Canada to pass legislation that required all municipalities within the province to prepare an asset management plan for all core municipal infrastructure. Municipalities have since been undertaking similar planning methods to all municipal infrastructure. Initial regulations required plans to have specific components including the Current State of the Infrastructure (a summary of replacement value, current condition, rate of depreciation and resulting residual value of the portfolio) as well as other components (Levels of Service, Asset Management Strategy, Financing Strategy and Improvement Plan). The State of Infrastructure reporting is a useful method to provide a snapshot of the current status of infrastructure and its ability to continue to deliver services. The City of Ottawa has been a leader in developing a comprehensive asset management program and making infrastructure investment based on a systematic approach. For example, State of the Infrastructure reporting is conducted for all asset types, and summarized in annual council reporting.

Minnesota DOT

MnDOT forecasts future funding in its annual Transportation Funds Forecast. This document projects funding by source for a four-year period. The report includes the funding projection, as well as additional details supporting the projections. For instance, it details trends in key parameters that impact funding, such as fuel consumption and vehicle sales. For these and other parameters the report shows historic trends, prior projections, and revised projection. The graph below, reproduced from the 2018 report, shows data for historic and predicted fuel consumption. The report also documents reasons for any changes in the projections, and risks that may impact future revenue. MnDOT uses its revenue projections to support development of the STIP, as well as to inform the funding projections in other reports, such as the TAMP and LRTP.

Source: MnDOT Transportation Fund Forecast. 2018. https://www.dot.state.mn.us/funding/documents/Transportation%20Forecast%20Feb%202018.pdf

City of Ottawa

The Province of Ontario was one of the first jurisdictions in Canada to pass legislation that required all municipalities within the province to prepare an asset management plan for all core municipal infrastructure. Municipalities have since been undertaking similar planning methods to all municipal infrastructure. Initial regulations required plans to have specific components including the Current State of the Infrastructure (a summary of replacement value, current condition, rate of depreciation and resulting residual value of the portfolio) as well as other components (Levels of Service, Asset Management Strategy, Financing Strategy and Improvement Plan). The State of Infrastructure reporting is a useful method to provide a snapshot of the current status of infrastructure and its ability to continue to deliver services. The City of Ottawa has been a leader in developing a comprehensive asset management program and making infrastructure investment based on a systematic approach. For example, State of the Infrastructure reporting is conducted for all asset types, and summarized in annual council reporting.