- Chapters

-

Chapter 5

Sections - Chapter 5 Home Page

- Chapter PDF

Chapter 5

Quick Links

5.3.2

Implications for Resource Allocation

In determining how to allocate financial resources, a decision-maker needs information on available funds. The output of the resource allocation process is an allocation of funds or other resources needed for the financial plan. Thus, financial planning both informs the resource allocation process and uses its results.

Development of a financial plan is separate from, but closely related to, the resource allocation process. Thus, there must be a high level of coordination between financial planning and resource allocation, particularly with respect to TIP and TAMP financial plans.

Although different financial plans are required for different applications, for practical purposes an organization should use consistent assumptions in developing its financial and strategic plans to the fullest extent possible, including the plans described above and other related documents.

Areas where integrated approaches and assumptions between different planning documents are most beneficial are:

- Revenue projections. Ideally, a single office or group should take responsibility for projecting future revenues incorporating the organizations best estimates of revenue sources, demographic trends and other factors.

- Inflation assumptions. To predict how much it will cost to perform work in current dollars it is necessary to apply an appropriate inflation assumption. Predicting future inflation is challenging and results of the resource allocation process may be highly sensitive to the assumed inflation rate. Thus, it is important for an organization to make a consistent set of assumptions concerning inflation in its different financial plans. Often, the same unit responsible for revenue projections also predicts future inflation.

- Operating and maintenance costs (O&M). Costs of operating and maintaining existing assets may be components of the different federally-required plans, but they typically are not a focal point of the planned use of capital funds. From an asset management perspective, it is important to accurately predict these costs and include them as part of any financial plan.

While integrating approaches is highly desirable, the varying scopes and requirements for different financial plans and statements may lead to different results even when approaches are integrated. Financial planners should still carefully document and communicate any areas where different financial plans and statements appear to diverge.

Such instances can result from:

- Timing of plan preparation. A transportation agency’s financial situation may change from year-to-year or even day-to-day. A financial plan captures an agency’s best estimates at a given point in time, and it is not uncommon that the financial assumptions made for a given plan will be different when revisited for another plan at a later time.

- Different planning horizons. Long-range plans, TIPS and TAMPs all have different planning horizons. The length of the planning horizon can impact how numbers are presented in a plan and how they are communicated. For instance, the aver- age annual O&M cost for the Federal-aid system, stated in current dollars, will be different over a 20-year period than over a 10- or 4- year period due to the effects of inflation and changing system conditions.

- Different contexts. Although using consistent assumptions and approaches between different financial plans and statements is desirable, in some cases the varying contexts and requirements demand the use of different approaches. An example of this issue is in asset valuation described in the previous section.

TIP

Although closely linked, financial planning should not be confused with resource allocation.

Minnesota DOT

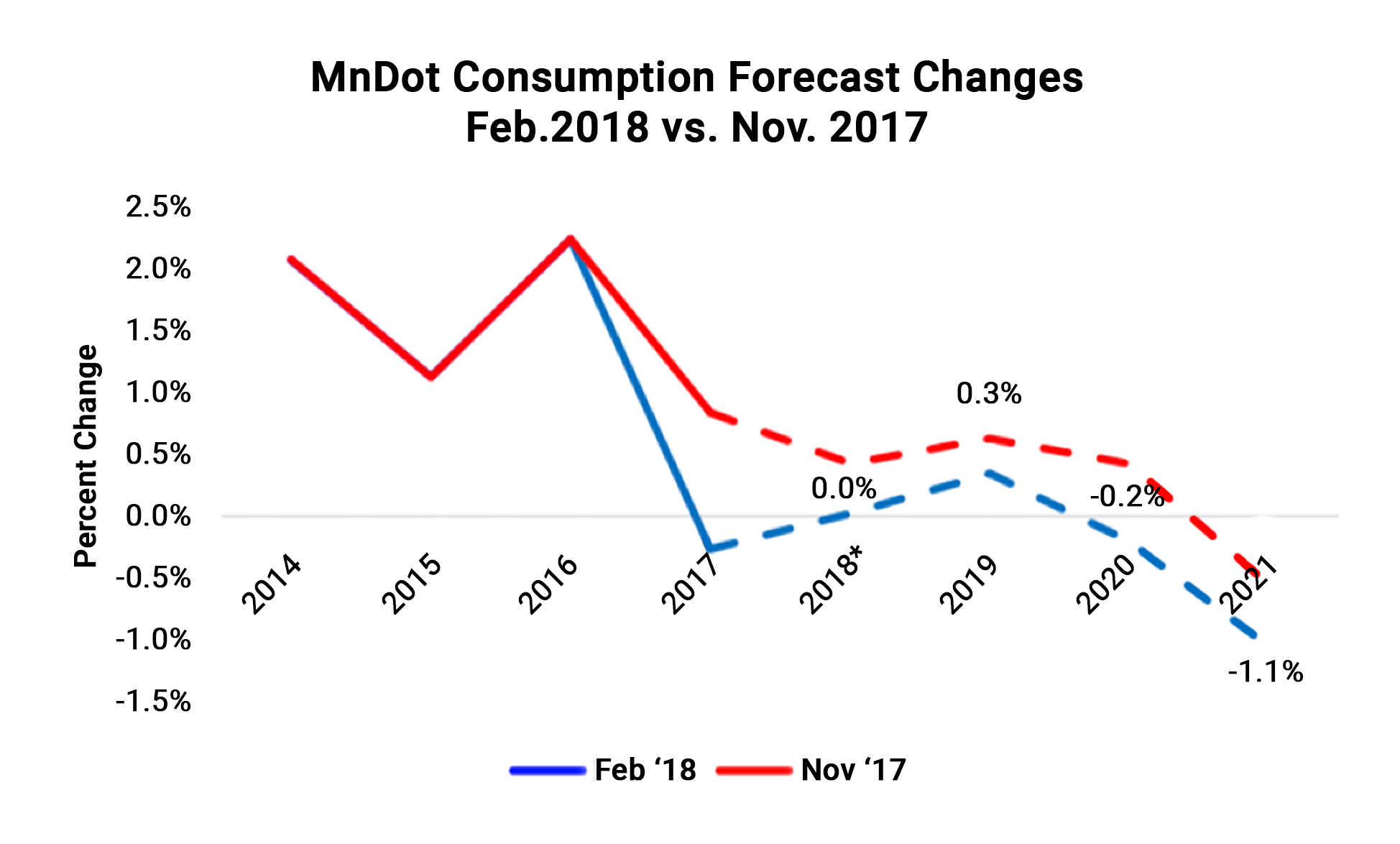

MnDOT forecasts future funding in its annual Transportation Funds Forecast. This document projects funding by source for a four-year period. The report includes the funding projection, as well as additional details supporting the projections. For instance, it details trends in key parameters that impact funding, such as fuel consumption and vehicle sales. For these and other parameters the report shows historic trends, prior projections, and revised projection. The graph below, reproduced from the 2018 report, shows data for historic and predicted fuel consumption. The report also documents reasons for any changes in the projections, and risks that may impact future revenue. MnDOT uses its revenue projections to support development of the STIP, as well as to inform the funding projections in other reports, such as the TAMP and LRTP.

Source: MnDOT Transportation Fund Forecast. 2018. https://www.dot.state.mn.us/funding/documents/Transportation%20Forecast%20Feb%202018.pdf

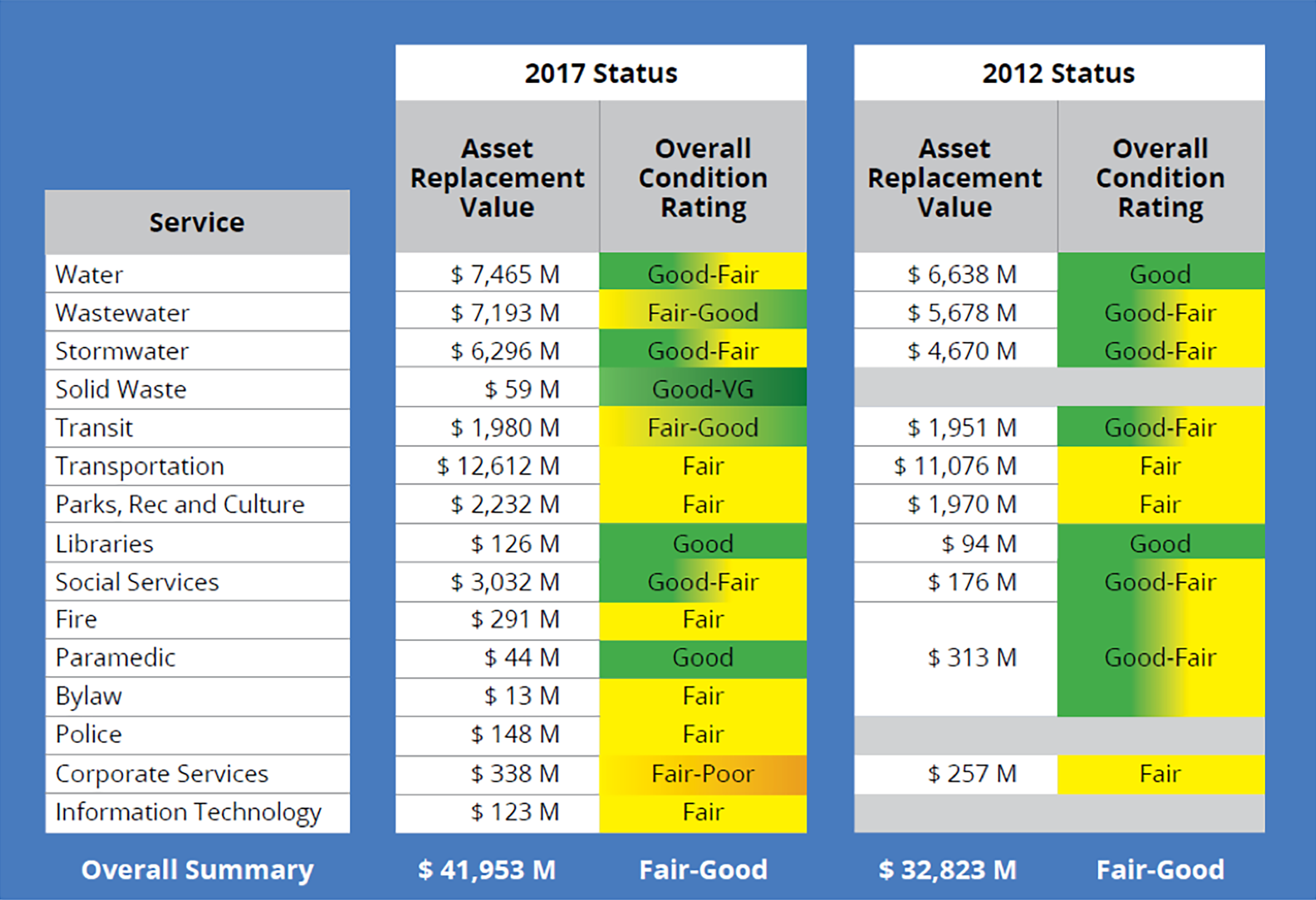

City of Ottawa

The Province of Ontario was one of the first jurisdictions in Canada to pass legislation that required all municipalities within the province to prepare an asset management plan for all core municipal infrastructure. Municipalities have since been undertaking similar planning methods to all municipal infrastructure. Initial regulations required plans to have specific components including the Current State of the Infrastructure (a summary of replacement value, current condition, rate of depreciation and resulting residual value of the portfolio) as well as other components (Levels of Service, Asset Management Strategy, Financing Strategy and Improvement Plan). The State of Infrastructure reporting is a useful method to provide a snapshot of the current status of infrastructure and its ability to continue to deliver services. The City of Ottawa has been a leader in developing a comprehensive asset management program and making infrastructure investment based on a systematic approach. For example, State of the Infrastructure reporting is conducted for all asset types, and summarized in annual council reporting.