Topic: Rules and Regulations

Rules and Regulations

This page features information on the rules and regulations relating to TAM. Learn more about legislative requirements and creating a TAMP below.

Legislation and Regulations

The federal government recognizes the importance of asset management practice and requires states to develop transportation asset management plans. Many state governments also have implemented laws related to asset management.

Federal Legislation

The transportation authorization legislation Moving Ahead for Progress in the 21st Century (MAP-21) signed into law in 2012 includes a number of provisions related to asset management and performance management for both highway and transit modes. The requirements established in MAP-21 were continued in the subsequent legislation Fixing America First Act (FAST) signed into law in 2015. For the highway mode MAP-21 defines asset management in the context of transportation and requires that State DOTs develop risk-based transportation asset management plans (TAMPs) for assets on the National Highway System (NHS). The law also includes a number of requirements related to performance management. Regarding transit MAP-21 requires that U.S. transit agencies develop TAMPs that detail asset conditions and include a prioritized list of state of good repair (SGR) investments.

Following passage of MAP-21 and FAST the Federal Highway Administration (FHWA) and Federal Transit Administration (FTA) developed rules detailing the TAM requirements for highways and transit, respectively. In 2016 FHWA finalized § 23 Code of Federal Regulations (CFR) Part 515 – Asset Management Plans. FHWA’s requirements specify that a TAMP should detail asset inventory, current conditions, and predicted future conditions over a 10-year period, using performance measures detailed in FHWA’s performance management regulations. The TAMP should include the following elements:

- Asset Management Objectives

- Asset Management Measures and Targets

- Inventory and Conditions

- Performance Gap Identification

- Life-Cycle Planning

- Risk Management Analysis

- Financial Plan

- Investment Strategies

In 2016, the FTA finalized asset management requirements U.S. transit agencies must follow. These requirements are detailed in §49 CFR Parts 625 and 630. The FTA requirements detail that transit agencies must prepare TAMPs covering a four-year period and including their revenue vehicles, infrastructure, facilities, and equipment (including service vehicles). Agencies must use a decision support tool to help analyze SGR investment needs and develop a prioritized list of needs. Larger agencies (with rail systems and/or 100 or more vehicles in peak revenue service) must include additional materials in their TAMP, such as a TAM/SGR policy, TAM implementation strategy, evaluation plan, and identification of resources required to implement the plan.

The Basic TAMP

A TAMP describes an agency’s goals and objectives for maintaining its assets over time. It describes an agency’s most critical assets, and their current condition. It also describes the agency’s strategy for preserving its assets, predict future conditions given the agency’s planned investments, formulate and deliver an investment plan, and discuss how the agency manages risks to its assets.

TAMP Requirements

This section discusses the requirements for a TAMP that is consistent with TAM leading practice. A TAMP includes:

- TAM Policies, Goals and Objectives

- Asset Inventory and Condition

- Life Cycle Planning Approach

- Predicted Asset Conditions

- Investment Plan

- Risk Management

Note there are additional specific requirements for a TAMP that is prepared to comply with Federal requirements. State DOTs are required to prepare a TAMP with a 10-year horizon that includes, at a minimum, NHS pavements and bridges. Transit agencies that receive Federal funds are required to prepare a TAMP with a four-year horizon that includes their revenue vehicles, facilities, infrastructure, and equipment (including service vehicles). FHWA provides a checklist of elements of TAMPs compliant with Federal requirements: https://www.fhwa.dot.gov/asset/guidance/certification.pdf. A similar FTA document is available at: https://www.transit.dot.gov/sites/fta.dot.gov/files/docs/regulations-and-guidance/asset-management/55371/compliancechecklistfy2018_0.pdf.

TAM Policies, Goals and Objectives

A TAMP summarizes an agency’s policies, goals, and objectives and describes how its approach to TAM helps support these. For instance, the document might discuss how maintaining assets in good repair supports the organization's broader goals for strengthening mobility and supporting economic development. It may also describe how the organization defines the desired state of repair of its assets, or criteria for evaluating whether or not an asset is in good repair. A clear linkage between TAM objectives and the achievement of wider agency goals should be directly illustrated within the TAMP.

TIP

The biggest benefit of developing a TAMP can come from the process as opposed to the product itself. Developing a TAMP can give agency staff a greater awareness of what assets they own, what condition they are in, and how their performance can be influenced by factors and decisions in other parts of the agency.

Asset Inventory and Condition

In preparing the TAMP, the agency must decide which asset classes to include in the document, and the level of detail in which the assets are described. For a highway plan, critical assets include pavements and bridges. A TAMP that is prepared to comply with Federal requirements must include these assets on the National Highway System at a minimum. Other assets addressed in a highway TAMP may include, but are not limited to: drainage assets such as culverts; traffic and safety assets such as signs, signals, and lighting; maintenance facilities; and Intelligent Transportation System (ITS) devices. For a transit plan, critical assets include revenue vehicles, facilities, infrastructure (for agencies that operate fixed guideway) and additional equipment, such as service vehicles.

A TAMP should provide a listing, typically in summary form, of the assets the agency has identified for inclusion. For each asset class the document should describe the physical extent of the asset, and current asset conditions. Chapter 3 of this document describes approaches for measuring asset condition and performance. Note that FHWA and FTA have developed specific requirements for reporting asset conditions for highway and transit assets, respectively. However, agencies are not limited to these measures, and may include multiple measures of condition in their TAMP to help provide a complete description of asset conditions.

Often it is helpful to place the data on an agency’s asset portfolio's current condition into some context. For instance, the TAMP may include photographs of representative asset condition to help illustrate what is meant by a given value for a performance measure. Also, a TAMP may include historic data on asset conditions to help illustrate condition trends.

Life Cycle Planning Approach

A critical component of a TAMP is a discussion of how an agency maintains its assets over their life cycle. Ideally the agency’s approach to life cycle planning should help maintain assets at a target level of service over their life cycle in the most efficient manner possible, while supporting agency goals and objectives. This section of the TAMP should describe the treatments the agency typically performs on its assets, and detail the analytical approaches it uses to assess investment needs, prioritize work, and predict future asset conditions. If the agency has implemented specific management systems for one or more of its asset classes, such as pavement, bridge or enterprise asset management systems, this section should describe those systems and how they are used to support decision making. Chapter 4 of this document provides further detail on life cycle planning.

Predicted Asset Condition

This section of the TAMP should describe how an agency’s assets are predicted to perform in the future. The horizon of the predictions should be commensurate with the horizon in the investment plan described in the next section. Typically the planning horizon is at least four years, but may be up to 20 years.

This sections should show what conditions are predicted given expected funding, as well as any gaps between predicted performance and the agency’s goals for its assets. This section may include results for multiple funding scenarios, particularly if there is uncertainty concerning future funding, or if including results for multiple scenarios helps document the process used to prioritize funding. For instance, the document might show predicted asset conditions over time given the current funding level, predicted future funding, and scenarios with more or less funding than the predicted level.

Investment Plan

The TAMP should detail planned investments given expected funding. Depending upon the agency size and assets included in the plan, the document might include specific investments the agency plans to make or projected funding levels by asset class and type of work. This section may provide additional details on sources of funding, and the agency’s specific strategy for investing in its assets considering available resources.

TIP

Although they can be combined, do not confuse a TAM Implementation Plan with a TAMP. The Implementation Plan should be actionable with defined monitoring/reporting timeframes for those who have been assigned specific tasks.

Risk Management

Managing transportation assets also entails managing risk. Considering risk is important in developing a TAMP, for the simple reason that there are various risks that, if they occur, may impact an agency’s ability to follow its TAMP. For instance, the occurrence of a natural hazard may require an agency to spend significant resources in response, to address or mitigate damage. Employing risk management strengthens asset management programs by explicitly recognizing that any objective faces uncertainty, and identifying strategies to reduce that uncertainty and its effects. This section of the TAMP should describe the agency’s approach to risk management. It should identify major TAM-related risks and describe the agency’s approach to addressing these.

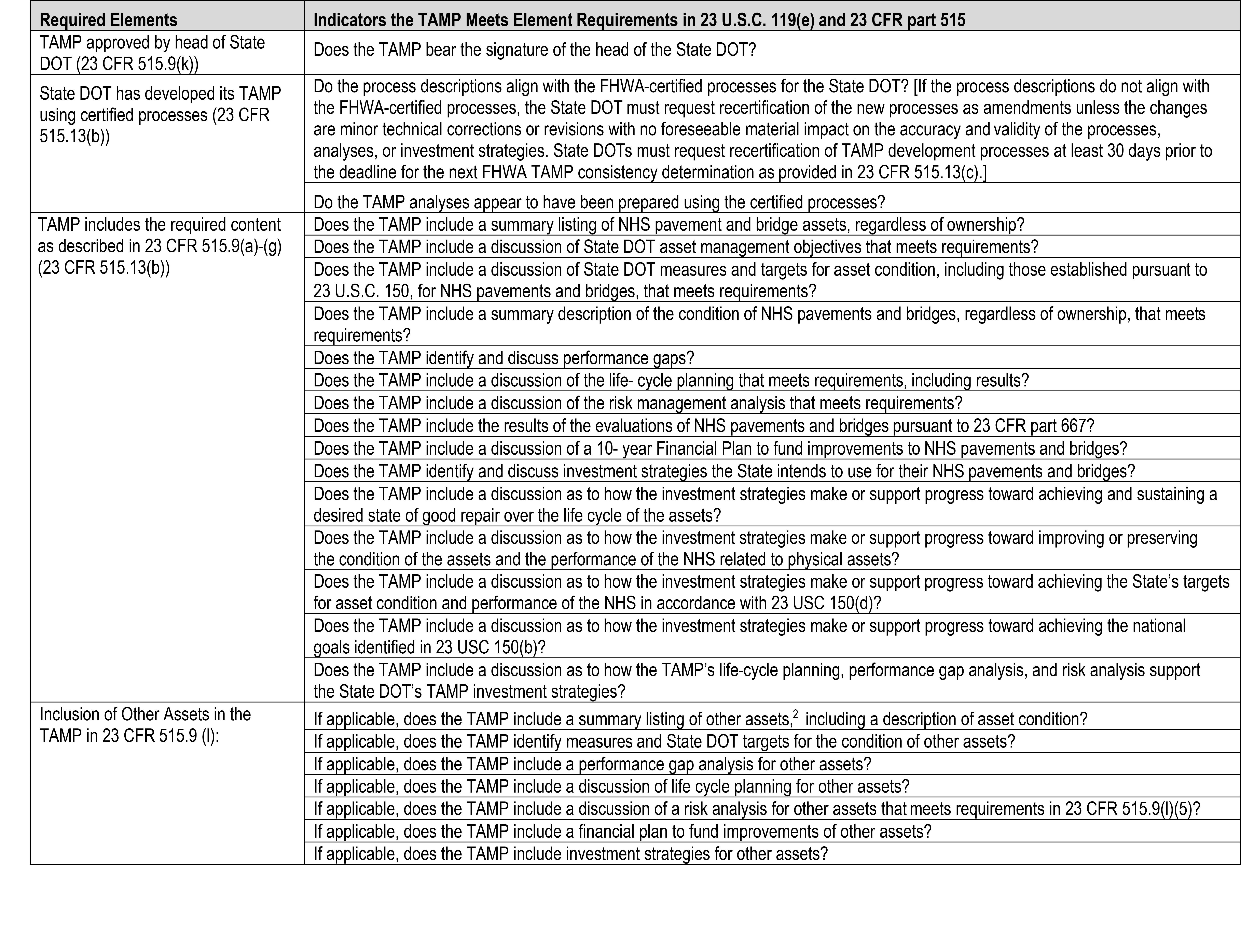

Colorado DOT

To ensure alignment with the requirements of MAP-21, Colorado DOT developed a requirements checklist that provides a quick reference/summary of the legislation requirements. The checklist is based on FHWA guidance (Transportation Asset Management Plan Annual Consistency Determination Final Guidance) that was issued in February, 2018. Its content was provided to help DOTs ensure their TAMPs are compliant and consistent with statute and regulatory requirements.

Source: FHWA. Transportation Asset Management Plan Annual Consistency Determination Final Guidance. https://www.fhwa.dot.gov/asset/guidance/consistency.pdf

Beyond the Basic TAMP

This section contains suggestions for developing a TAMP that goes beyond the basic elements of a TAMP described in the previous section. An agency can expand the scope of the TAMP to include additional asset types and systems. An agency may further tailor their TAMP to address specific needs.

TAMP Scope

A highway agency focused on complying with Federal requirements will typically focus on including its NHS pavements and bridges in its TAMP. While these assets make up the greatest portion of a typical state highway agency, an agency may wish to include additional assets in its TAMP. Also, the agency may wish to extend the network scope of the TAMP. In updating a TAMP with NHS pavement and bridges, an agency may include other assets, such as drainage assets, traffic and safety features, or the agency may wish to include all of the assets it owns.

For transit TAMPs, the initial focus is on revenue vehicles, facilities and infrastructure, as these are the assets that require the greatest investment. An agency may wish to expand its TAMP to include additional assets that are important to the systems, albeit less costly, such as bus shelters and signage.

TAM Implementation Plan

As described in Section 2.3, it is often helpful to prepare an implementation plan describing a set of planned business process improvements that an agency intends to undertake to strengthen its approach to TAM. There are many examples of TAMPs that focus specifically on an agency’s TAM approach and how it plans to improve its approach. Ideally a TAMP should both describe an agency’s assets and planned investments, and detail how it intends to improve its TAM approach. Where an agency has developed both a TAMP and TAM implementation plan, the implementation plan can be incorporated as a section of the TAMP.

TAM-Related Business Processes

An agency may wish to include a discussion of one or more of the business processes related to TAM in its TAMP. Alternatively, there may be other agency documents that provide more detail on these issues that can be referenced in the TAMP. These areas include:

- Performance Targets. As described in Chapter 5, setting performance targets can help guide the resource allocation process. However, agencies often have broader efforts to establish and track performance beyond the scope of TAM.

- Financial Planning. While developing a TAM investment plan is central to developing a TAMP, often the revenue forecast used to support developing the investment plan is developed separately and used for other purposes beyond the scope of TAM. It may be valuable to document the agency’s approach to forecasting future revenues for TAM and other applications. Chapter 5 describes provides additional detail on this topic.

- Work Planning and Delivery. As described in Chapters 4 and 5, work delivery approaches can impact how assets are maintained over their life cycle, and how resource allocation decisions are made. Some agencies have adopted formalized approaches for evaluating and selecting different work delivery approaches.

- Data Management. Chapter 7 discusses the importance of implementing an approach to data management and governance. Some TAMPs include additional information on this topic given its relationship to TAM.

AASHTO TAMP Builder

The AASHTO TAMP Builder website (available at https://www.tamptemplate.org/) hosts annotated plan outlines to assist agencies in preparing TAMPs. The site also provides resources to customize an outline in order to meet agency-specific objectives and requirements. The website integrates a database of TAMPs, dating from 2005, that support the functionality of the outlines created using the site.

Practice Examples

Michigan DOT

MDOT’s strategic plan has seven strategic areas of focus. A key focus area is System Focus, which aims to provide cost-effective, integ…

Oklahoma DOT

The Oklahoma DOT identified the following TAM objectives to help guide their asset management program:

- Maintain (improve) th…

Amtrak

Amtrak’s Engineering Asset Management policy identifies guiding principles that the agency intends to use in managing the infrastructur…

Seattle DOT

Adopting Asset Management Principles

Seattle is one of the fastest growing cities in the U.S. and the demands on the transportation system have grown dramatically. Meanwhile…

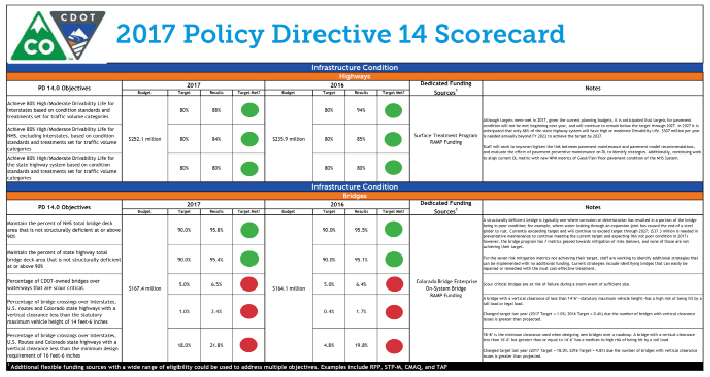

Colorado DOT

Creating an Asset Management Policy

In 2015, the Colorado Department of Transportation (CDOT) updated Policy Directive 14 (PD 14.0) “Policy Guiding Statewide Plan Developm…

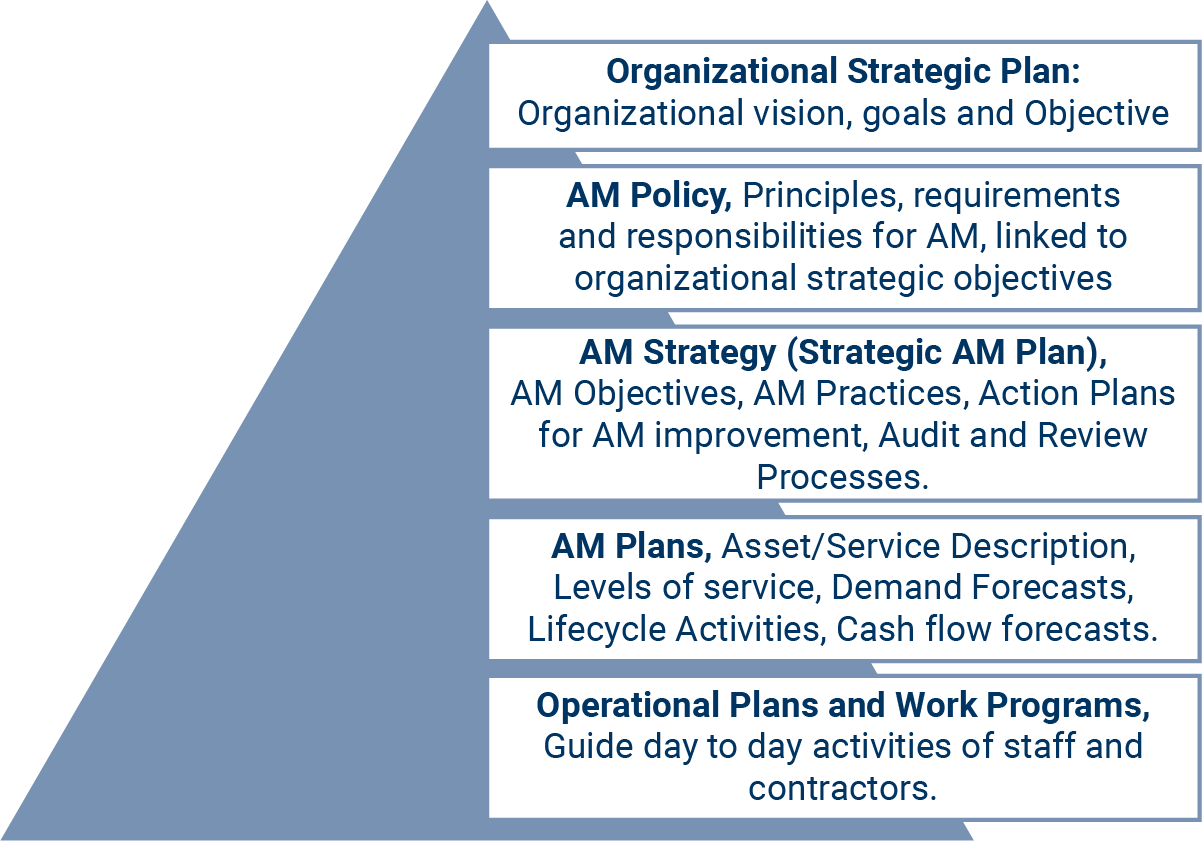

ISO 55000

Strategic Asset Management System

ISO 55000 adopts the concept of an Asset Management System, as the figure at right illustrates, which typically consists of several compo…

Montana DOT

Aligning a TAMP to Broader Planning Initiatives

When developing their 2018 TAMP MDT aligned their pavement performance targets and goals to those within their planning document TranPlan…

British Columbia

Alignment Between Policies, Investments, and Practices

To support the alignment of agency policies, objectives and day-to-day practices, the Province of British Columbia established the tiered…

Arkansas DOT

As part of the process of developing its 2018 TAMP, ARDOT developed a risk register and mitigation plan compliant with FHWA TAMP requirem…

Ohio DOT

Transportation Information Mapping System (TIMS)

Ohio DOT (ODOT) has focused on data and information management improvements as a foundational element of their asset management program. …

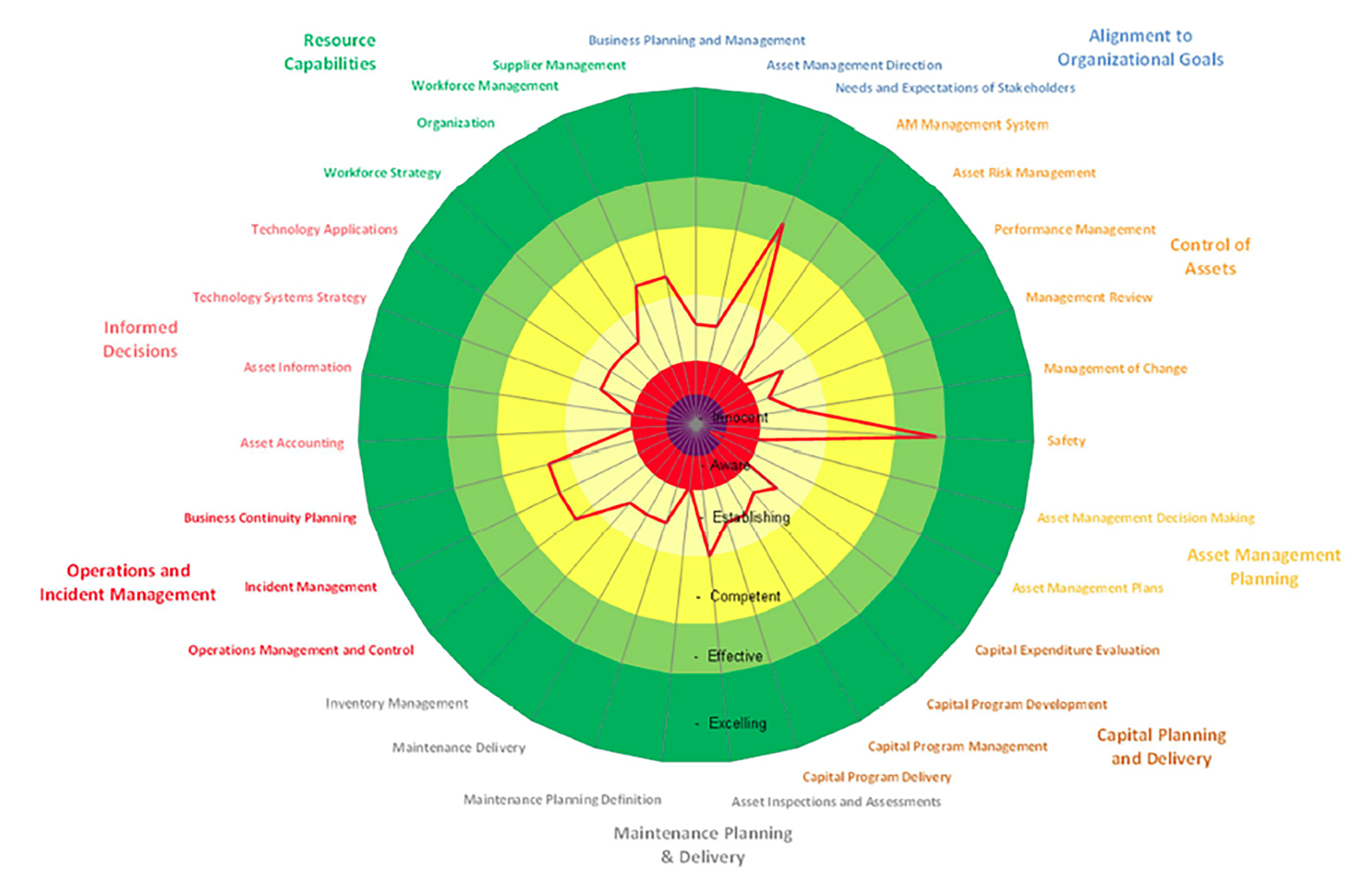

Amtrak

In 2016, Amtrak Engineering undertook an Asset Management Capability Assessment which bases maturity on the degree of formality and optim…

Utah DOT

To accomplish the objective of allocating transportation funding toward the most valuable assets and those with the highest risk to syste…

Practices

Integrating TAM Within Agency Strategic Plans & Policies

- Asset management principles are adhered to by some asset management advocates within the agency, but adherence to them is not universal.

- Investment is allocated within service areas (Transit, Highways, Active Transportation, Multi-model Systems) and the asset portfolios (pavements, bridges, transit fleet and facilities) that support them, based on the performance management targets that have been set.

- Asset management principles such as inter-generational equity, triple bottom line decision making, whole of life and service driven decision making can be found in some strategic plans, agency goals and high-level, long term planning documents.

- Investment is sometimes evaluated between asset portfolios (pavements, bridges, transit fleet and facilities), and funding is partially allocated based on a linkage to stated objectives.

- Asset management principles such as inter-generational equity, triple bottom line decision-making, whole life and service driven decision making are embedded within strategic plans, agency goals and high-level, long term planning documents.

- Investment is systematically allocated between service areas (Transit, Highways, Active Transportation, Multi-model Systems) and the asset portfolios (pavements, bridges, transit fleet and facilities) that support them, based on the requirements to achieve stated objectives and service level commitments.

Creating a TAM Policy

- An Asset Management Policy has been drafted or adopted by elected officials and is guiding in-progress changes to investment and operational decision making in the organization

- Policy principles are providing a basis for change and action in the delivery of services with infrastructure.

- An Asset Management Policy has been adopted and influences capital investment decision making in the organization

- The Policy is implemented at high levels within the organization, and its principles help determine overall focus on improving the asset management system action in the delivery of services with infrastructure.

- An Asset Management Policy has been adopted by elected officials and it strongly influences investment and operational decision making in the organization

- The Policy is implemented across the organization, and its principles strongly guide process, and action in the delivery of services with infrastructure.

Organizational Models

- There is an increasing awareness of asset management among staff in some key departments within the organization and they are piloting or demonstrating though leading practice. There is an understanding that service delivery and decision-making should follow a systematic approach.

- There is an organizational structure that supports implementing and sustaining asset management practices consistently in each department of the organization.

- There is a culture of asset management and an awareness among most staff that relationships exist between service delivery, infrastructure decision-making, and clear improvement actions to enhance the asset management system further.

- There is an organizational structure that supports the continuous improvement of asset management practices consistently across the organization.

- The is a culture of asset management and an awareness among all staff within the organization that touches all aspects of service delivery and infrastructure decision-making at the strategic tactical and operational levels.

- There is an organizational structure that supports implementing and sustaining asset management practices consistently across the organization. Embedded in the process are steps to continuously improve the organizational model and business processes.

Roles

- Roles and responsibilities associated with the Asset Management Framework and have been defined, and the organization has begun the transition to the planned management system approach.

- Senior leadership and some key staff involved in implementing asset management in the agency understand their role, and are accountable for ensuring asset management is embedded fully within the organization over time.

- Roles and responsibilities associated with the Asset Management Framework and its processes are defined in most departments.

- Key personnel in the organization including top management and other staff understand their role, and are accountable for ensuring asset management continuously improving across the organization.

- Roles and responsibilities associated with the asset management framework and its processes are clearly defined and are functioning effectively.

- Everyone in the organization, from top management, to field staff, understand their role, and who is accountable for ensuring asset management is embedded fully within the organization.

Competencies

- There is sporadic communication within the organization and externally to relevant stakeholders to help build support for the asset management framework and management systems.

- Staff have growing awareness, knowledge, and capabilities to perform their role in alignment to the asset management system.

- Attempts are made to implement change management strategies to improve and strengthen the asset management program.

- There is regular communication within the organization and externally by the agency that helps build support for the asset management framework and management systems.

- Key staff have an appropriate level of awareness, knowledge and capabilities to perform their role in implementing and improving the asset management system.

- Change management tactics are developed in response to resistance to implementing actions that strengthen the asset management program.

- There is consistent, aligned and supportive communication within the organization and externally to relevant stakeholders that helps build support for the asset management framework and management systems

- Staff have an appropriate level of awareness, knowledge and capabilities to perform their role in alignment to the asset management system.

- A well crafted change management strategy helps implement improvement actions that strengthen the asset management program.

Data and Systems for Life Cycle Management

- A computerized maintenance management system is being implemented/customized to better understand operations and maintenance activities within the agency.

- Some basic asset modeling is used to predict asset performance in the future for financial planning purposes.

- Computer management systems meeting the minimum federal requirements are implemented and used for compliance.

- A computerized maintenance management system captures operations and maintenance costs within the agency and assigns these to assets appropriately.

- Appropriate probabilistic and deterministic modeling techniques are used to predict asset performance for high value assets.

- A computerized maintenance management system captures operations and maintenance costs within the agency, and supports trade-off analysis between capital investment and operations and maintenance intervention alternative tactics

- Appropriate probabilistic and deterministic modeling techniques are used to predict asset performance in the future, and inform financial planning and intervention selection.

Managing Assets for their Life Cycle

- Alternative management strategies are considered for high value/critical asset classes in the portfolio and selected based on efficiency and effectiveness of the transportation network.

- Asset reliability is qualitatively considered in a systematic way for some asset classes.

- Reactive and interval-based approaches that are based on risk assessments are used where appropriate.

- Management strategies are periodically re-evaluated to determine if a change in management practice would be more effective.

- Deployment of maintenance crews, capital projects, and network operation resources are coordinated to ensure the right interventions are occurring in the right locations, at the right time on the transportation network to deliver mobility service levels at an acceptable cost and level of risk.

- Appropriate condition, interval and reactive based management strategies have been established for most asset classes.

- Asset reliability is well understood and is aligned with risk tolerance in the agency.

- Assets are planned, acquired and managed with an awareness of the costs, risks, and service performance characteristics over the entire life cycle.

- Appropriate management strategies are established and periodically re-evaluated to determine if a change in management practice would be more effective.

- Deployment of maintenance crews, capital projects, and network operation resources are coordinated to ensure the right interventions are occurring in the right locations, at the right time on the transportation network to deliver mobility service levels at an acceptable cost and level of risk.

- Appropriate condition, interval and reactive based management strategies have been established for every asset class in the portfolio, to support management of the transportation network efficiently and effectively.

- Asset reliability is well understood and is aligned with service expectations and risk tolerance in the agency.

- Strategic, tactical and operational activities directly consider alternatives that balance service delivery and investment of resources.

- Reactive and interval-based approaches that are based on risk assessments are used where appropriate.

- Management strategies are periodically re-evaluated to determine if a change in management practice would be more effective.

- Deployment of maintenance crews, capital projects, and network operation resources are coordinated to ensure the right interventions are occurring in the right locations, at the right time on the transportation network to deliver mobility service levels at an acceptable cost and level of risk.

Levels of Service

- Customers are identified, but outreach is not formalized.

- Some technical levels of service or KPIs are defined and considered when intervention alternatives are being evaluated.

- Customer groups are defined and some communication practices are in place to assess wants.

- KPIs are established, but may not be tightly tied to business decisions.

- Maintenance levels of service are established, but there is not a tight connection to KPIs.

- Technical levels of service are defined, and measured to evaluate the effectiveness of past investment and operational decisions.

- Customer groups are defined and clear policies and procedures are in place to assess wants.

- Customer-based KPIs and maintenance levels of service are established at the strategic, tactical, and operational levels.

- Agency performance is routinely measured and reported to all internal and external stakeholders.

Resource Allocation and Prioritization

- The goals of infrastructure investment and management are clearly defined.

- The long-term investment requirements are understood for all asset classes in the existing portfolio and is based on at least a 20-year horizon to capture near term investment needs and is based on known intervention and replacement costs.

- Investment prioritization is directly linked to goals for the agency.

- A systematic, repeatable approach is used to allocate resources for high value assets in some departments who are managing infrastructure.

- Alternative delivery options considered where problematic issues are encountered.

- The goals of infrastructure investment and management are clearly defined.

- The long-term investment requirements are understood for all asset classes in the existing portfolio, and is based on at least a 20 year horizon, as appropriate to capture all known large interventions for high value assets, and is based on known intervention and replacement costs.

- Investment prioritization is directly linked to goals and performance measures are qualitatively evaluated in the prioritization process.

- A systematic, repeatable approach is used to allocate resources, and the process is well understood by key decision-makers in the agency.

- Resource allocation methods are trending to become consistent across the agency in the near term.

- Alternative delivery options are periodically evaluated in some departments to consider alternative use of resources for service delivery.

- The goals of infrastructure investment and management are clearly defined.

- The long-term investment requirements are understood for all asset classes in the existing portfolio, and is based a sufficient horizon to capture the expected service life for all owned assets, and is based on known intervention and replacement costs.

- Investment prioritization is directly linked to goals, performance measures and evaluated against the constraints that may exist for the agency.

- A systematic, repeatable approach is used to allocate resources, and the process is well understood and employed across the agency by all departments managing infrastructure.

- Resource allocation methods are consistent across the agency and supports cross-asset resource allocation methods, where appropriate.

- Alternative service delivery options are periodically evaluated systematically to ensure the best use resources for service delivery.

Cross Asset Resource Allocation

- Basic decision support tools are embedded across the organization and used to qualitatively inform decision-making for funding allocation between asset classes.

- Multi-objective allocation approaches are being considered or trialed to allocate funding across asset classes to balance risk, service delivery and investment.

- Service levels and associated performance measures are evaluated and considered for allocation decisions

- Decision support tools including computerized systems are being procured or implemented to inform decision-making for funding allocation in the future near term.

- Appropriate multi-objective allocation approaches are established in the agency and employed to allocate funding across asset classes to balance risk, service delivery and investment.

- Service levels and associated performance measures are evaluated and linked directly with allocation decisions

- Decision support tools including computerized systems are embedded across the organization, and used to inform decision-making for funding allocation.

Performance Measurement and Management

- Some key performance measures are established within the organization and are beginning to be measured.

- Performance measures are periodically reviewed and enhanced over time.

- Regular reporting of progress with trends tracked over time.

- Performance measures are established within the organization and provide a strong linkage between agency objectives and the processes for capital decisions.

- Regular reporting of progress with clear trends indicating improvement.

- Performance measures are well established within the organization and provide a strong linkage between agency objectives and the processes for capital and operational decisions.

- Performance measures are directly used to prioritize investment needs.

- Regular reporting of progress with clear trends indicating significant improvement over time.

Monitoring the State of Assets

- Asset data collection and management is in transition to better support timely and accurate performance reporting.

- The performance measurement framework is evolving to improve goal alignment and trend the agency to desired outcomes.

- Asset data collection and management supports performance reporting.

- Periodic review of performance measurement framework is carried out to confirm measures are appropriate, aligned with objectives and suitable to trend the agency to desired outcomes.

Monitoring Funding and Resource Allocation Methods

- Trend analysis is employed by the agency to help identify potential adjustments to improve performance targets.

- Trend analysis and other analytical tools are being trialed by the agency to help identify potential adjustment actions to improve performance.

- Current status is understood by all internal stakeholders, and resource allocation in some departments is supported by informed decision-making.

- Trend analysis, performance forecasting and other analytical tools are employed by the agency to help identify potential adjustments to operational, tactical or strategic actions to help achieve performance targets.

- Current status is understood by all internal and external stakeholders, and resource allocation is supported by informed decision-making.

Monitoring Asset Work and Costs

- The agency is improving its ability to track operations and maintenance costs and capital investments and link them to assets in the portfolio.

- Some departments can analyze the effectiveness and efficiency of their alternative interventions.

- The agency tracks operations and maintenance costs and capital investments, and these are linked to the asset to which they apply.

- Analysis is periodically carried out to assess efficiency of alternative interventions.

- The agency has accurate method of tracking operations and maintenance costs and capital investments, and these are linked to the asset to which they apply.

- Analysis is periodically carried out to assess the effectiveness and efficiency of the alternative interventions and trade-off between maintenance and capital decisions.

Tracking and Managing Risks

- The agency has identified some operational risks, manage them in a risk register and have established targeted mitigation strategies.

- The agency has an integrated risk management framework that allows risk to be employed at a more than one level within the agency.

- High risks are proactively managed or leveraged.

- The agency has an integrated risk management framework that allows risk to be employed at strategic, tactical, and operational levels.

- Risks are proactively managed or leveraged.

- Managed risks show reduced frequency of negative consequences or opportunities are captured as appropriate.

- TAM processes are evaluated regularly for improvement.

Collecting Asset Data

- Collection occurs periodically and data is maintained, current and accurate.

- Data collection strategies are targeted to agency decision-making requirements.

- Collection occurs periodically and data is maintained, current and accurate.

- Data collection strategies are targeted to agency decision-making requirements, and collection resources add value.

- Collection occurs periodically and data is maintained, current and accurate.

Information and Systems

- Agency information systems are unintegrated, however the current portfolio of systems are well mapped, and an improvement plan is in progress to improve integration toward a clearly defined future state that is suited to agency requirements.

- Agency information systems are partially integrated, interconnected and a plan is being implemented to create a system that is suited to agency requirements.

- Agency information systems are fully integrated. Systems supporting inventory management, data warehouses and statistics, inspections and condition assessments, maintenance management, performance modeling, analytics, forecasting and financial systems are interconnected and are suited to agency requirements.

Asset Data Sharing, Reporting and Visualization

- Information is available to most stakeholders and allow for improving decisions over time.

- Data and analysis presentation is improving with a plan for consistency across the agency.

- Information is available to most stakeholders and allow for informed, supported decisions

- Data and analysis presentation is improving and is targeted to key decision-makers, and consistent across the agency.

- Information is available to all stakeholders and allow for informed, supported decisions

- Data and analysis presentation is well crafted, easy to understand for the targeted audience, and consistent across the agency.

Data Governance and Management

- Data governance and management practices are being established with a gap assessment identifying an improvement strategy over time.

- Data governance and management practices well established and support continuous improvement in data systems.

- Data governance and management practices well established and support reliable, consistent, integrated and accessible data systems

- Governance frameworks are reviewed periodically to ensure it evolves with agency requirements.